GameStop and BlackBerry shares soar on amateur traders’ fervour

Shares in GameStop and BlackBerry rocketed in New York on Monday as amateur online traders continued their assault on professional investors betting that the stocks were overvalued.

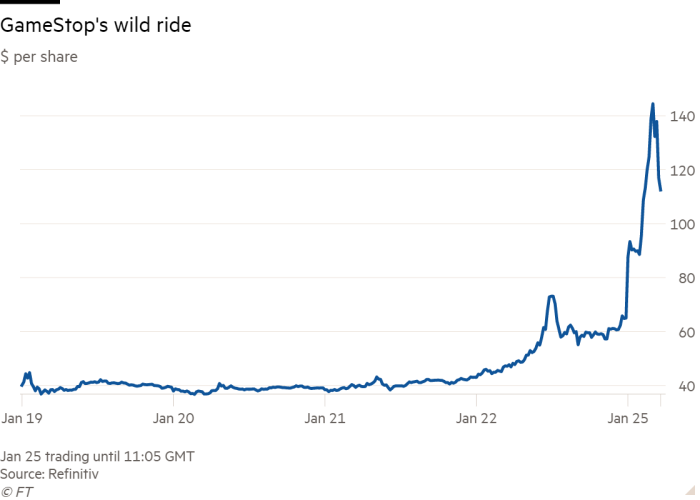

Gaming retailer GameStop jumped as much as 120 per cent and its stock was repeatedly halted to calm volatile trading, before falling back to trade 10 per cent higher.

The outsized gains, without significant corporate news, built on a rally on Friday that exceeded 100 per cent at its peak. Shares in BlackBerry, the tech company once famed for its handsets, soared as much as 47 per cent on Monday, taking the price to more than double its level at the start of the year.

The activity has underscored the impact of social media and cheap trading on Wall Street in the past year, where $500bn a day of deals are filtered through a network of banks and brokers and executed in microseconds.

Both companies are popular among amateur traders who share ideas and tips on the r/wallstreetbets message board on the website Reddit. Other companies such as Palantir Technologies, the US data analytics group, have also been widely discussed.

One Reddit user claimed he had taken his father’s life savings and put it all into BlackBerry stock with a “you only live once” attitude. “Told him ‘It’s either retirement on a yacht or food stamps for him’.”

Friday’s drama in GameStop shares came after short seller Citron Research said the value of the company should halve from $40 as it was “pretty much in terminal decline”. Retail trading enthusiasts retaliated by buying options in GME, helping to push the stock above $65.

“All the sentiment positioning indicators are geared towards the institutional world,” said one investment bank analyst. “How do you gauge sentiment on Tik Tok? How do you gauge sentiment in gifs or memes? I don’t know.”

Small investors can influence share prices by buying large amounts of call options, which give the user the right but not the obligation to purchase a share later at a fixed price.

Typically, this means that wholesale brokers such as banks need to purchase shares on the open market to hedge themselves against the event that the stock price hits the strike price of the option.

This hedging can have an outsized impact on prices, particularly in smaller stocks if a large percentage of the company’s stock is on loan for institutional investors to make a profit by selling short.

In the first hour of Monday’s trade more than 400,000 options contracts in GameStop had been purchased, higher than totals on the full trading day over the past 50 days.

The activity by day traders has been fuelled in part by brokers moving to commission-free trading and a sharp rebound in stock market valuations since last March’s sharp sell-off.

“As someone who started trading stocks in the late ’90s in college, I would always remember watching when the small retail trading groups would get crushed by hedge funds and savvy short sellers,” said Edward Moya, senior market analyst with Oanda, a foreign exchange specialist, in New York.

“What happened with GameStop’s stock is a reminder of how times are changing. A new army of traders are not focused on valuations, but rather by momentum opportunities they see from Reddit’s Wall Street Bets, YouTubers, TikTok or Robinhood.”

By law US exchanges are required to ensure a fair and orderly market for trading. The New York Stock Exchange, where GameStop is primarily listed, had no comment on the matter.

BlackBerry said in a statement that it was not aware of any material, undisclosed corporate developments that would account for the recent increase in the market price or trading volume of its common shares.

Additional reporting by Eric Platt and Katie Martin.